Traditional Traders Are Ready to Go Crypto and Prefer Bitcoin

In a report named Institutional Adoption of Digital Asset Trading, compiled by the Acuiti management intelligence platform, in conjunction with the CME Group and the Bitstamp crypto exchange, authors claimed that survey data “suggests the digital assets market is on the cusp of significant growth from traditional trading firms.”

The findings were based on a survey of 86 senior executives “across the sellside, proprietary trading firms and the buyside.” The authors stated that its respondents from non-bank Futures Commission Merchants, proprietary trading firms and the buyside “tended to be C-suite [the executive-level managers],” while banking and brokerage respondents were primarily “heads of function at managing director level.” The findings were announced this week. However, the authors did not specify whether the survey was conducted before or after the market crash in March.

In either case, according to the survey, although most “traditional trading firms” still refuse to handle crypto, the tide could be about to turn.

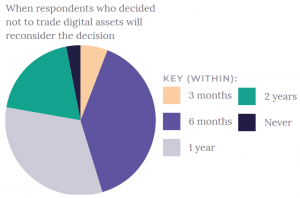

The authors wrote,

“97% [of trading firms] will consider the opportunity again in the next two years or less and 45% are planning to revisit the idea in six months or less.”

What’s stopping them? Yes, you guessed it – it's regulation again.

Crypto exchanges report uptick in trade volumes as coronavirus impacts the global economy

The coronavirus pandemic has pushed global markets into a state of shock – but major cryptocurrency exchanges appear to remain unaffected.

Seven crypto exchanges The Block spoke with – including centralized, decentralized and peer-to-peer (P2P) marketplaces – said they have witnessed increased user numbers and trading volumes since the pandemic started escalating.

"We've seen a significant uptick in sign-ups and a 300% increase in verified accounts," Dave Ripley, chief operating officer at Kraken, told The Block. Ripley did not disclose specific user numbers, but said Kraken currently serves "millions of clients around the world."

OKEx has also seen "steady" growth in its user base, CEO Jay Ho told The Block. "Especially during early-March, we recorded an estimated 1.7% boost globally."

Quick Take

- Major cryptocurrency exchanges appear to remain unaffected by the COVID-19 pandemic’s economic impact

- At least seven exchanges The Block spoke they have seen an uptick in user sign-ups and trading volumes

- These include Kraken, Gemini, Bitfinex, OKEx, Bitstamp, Paxful, and KyberSwap.

Erisx Launches Regulated Bitcoin Futures Market BTC $BTC

Crypto trading platform Erisx has launched a bitcoin futures market regulated by the U.S. Commodity Futures Trading Commission (CFTC). Its physically-settled bitcoin futures contracts trade alongside its spot market which supports four cryptocurrencies. Erisx has obtained a license from the U.S. Financial Crimes Enforcement Network (FinCEN) and is currently approved to operate in 44 states, with a plan to expand to 53 states and U.S. territories.

Article Published on Bitcoin.com

Physically Settled, Regulated Bitcoin Futures

Erisx announced on Tuesday the launch of its regulated bitcoin futures market. The platform’s physically-settled bitcoin futures contracts are offered alongside its spot market for “price transparency and collateral efficiency,” the company detailed. Initially, only monthly and quarterly contracts are offered.

Since the contracts are physically settled, “settlement will be made by the movement of the digital currency to the buyer of the futures contract and US dollars to the seller of the contract,” Erisx’s website describes. The current requirement to become a member of the platform is a minimum balance of $10,000.

Erisx’s current futures product.

Prior to Tuesday’s launch, the company ramped up its team and developed technology for its exchange’s matching engine (TME) and clearinghouse’s clearing system (TCS). The company also developed risk-mitigating functionality to enable efficient price discovery such as self-match prevention, price banding, and maximum order sizes. Its futures clearing platform was built from scratch. Currently, Erisx’s spot trading platform supports BTC, BCH, ETH, and LTC, which can be traded against the USD or BTC >> READ MORE

Announcing LiveView: Look into the top of book for any crypto currency pair across all of the major exchanges

Announcing LiveView by Mainbloq: your live view into the crypto markets. We built LiveView to demonstrate to our clients the power of our technology, now we're giving it to anyone with a web browser: www.mainbloq.io/liveview

We're always building new technology for our clients—you may have read about our Smart Order Router and Trading Algorithms in previous articles—but today we're releasing something for EVERYONE.

What's in LiveView:

- An insider's look into the top of book for any currency pair across all of the major exchanges and their liquidity pools.

- See total volume and liquidity for currency pairs across exchange in real-time.

- Identify price differences between exchanges to see where to get the best price.

- A real-time calculation of stable rates normalized to give the true best price.

So what can you do with LiveView? You can trade smarter. That's what we're all about at Mainbloq, we give you the tools to make better trading decisions.

The one thing that we see as most salient is if you are only executing on one exchange you are leaving money on the table. To make the most efficient trades you need to execute cross-exchange.

One thing you can't do from LiveView is trade. If you're looking to trade smarter in real-time contact us here: https://mainbloq.io/contact/

About Mainbloq

Mainbloq is a data, research, and technology company focusing on blockchain and digital assets. Mainbloq offers a cloud-based, modular platform including a smart order router, suite of trading algorithms, the ability for clients to integrate their own algorithms, and consulting services to help clients execute on their trading strategies. Mainbloq is building the best-in-class platform for researching and trading digital assets. For more information visit https://mainbloq.io/

FinanceMagnets.com: Mainbloq Launches Algorithm Suite for Crypto Trading

The suite has 8 algorithms to offer.

Arnab Shome | News ( CryptoCurrency ) |

The crypto analysis company has launched a suite of cryptocurrency trading algorithm to automate the trading process.

MainBloq has kept the suite versatile considering the wide spectrum of the crypto trading market. The company’s algorithm can be used within its proprietary order management system. It has also launched API support, which will enable the algorithm to be integrated into any third party OMS or EMS, detailed the April 4th announcement >> READ MORE

Here come the crypto trading algorithms

After spending a few decades on the street I got to see first-hand how the trading algorithm revolution lead to sophisticated and complex strategies that were necessary to execute trades efficiently and effectively. This revolution is coming to cryptocurrency.

First, let’s define what a trading algorithm is—simply put, algorithms are a method of executing orders using a set of rules based on a multitude of dimensions (volume, time, venue) in order to fan out orders to accomplish certain objectives (speed, secrecy, price).

The most important thing to remember is that not all algos are created equal. That’s why we’ve assembled a team of street veterans with experience crafting algorithms for some of the most successful shops.

Our algorithms include a blend of well-established algorithms along with custom algorithms created by our team. Unlike most existing cryptocurrency algorithms, all of our algorithms execute across multiple venues. Our algorithms can be blended according to each individual trader’s strategy.

- BASKET - Executes multiple trades of multiple coins simultaneously and over a period of time using TWAP or other time-based strategies.

- TWAP (Time Weighted Average Price) - Executes trades evenly over a specified time period

- VWAP (Volume Weighted Average Price) - Executes trades evenly based on trading volume.

- THOR - Executes one order across multiple venues so they arrive at each venue at the same time to minimize market impact.

- ICEBERG - Executes orders in random slice sizes over a period of time over multiple venues to minimize market impact.

- Pairs Trades - Executes two trades of individual coins while maintaining a balance between the long and the short side of the trade.

- IWAP (Information Weight Average Price) - A custom Mainbloq algorithm that trades in windows of fixed notional while varying the duration.

- ISR (Implementation Shortfall Reducer) - A custom Mainbloq algorithm that reduces slippage and balances market impact by controlling the rate of execution.

These algorithms are just the start. We’re crafting sophisticated strategies to ensure our clients can execute effectively and efficiently. We also work with our clients to create tailored algorithms so they can execute their trading strategies.

Our mission at Mainbloq is to bring the sophistication of traditional finance to digital assets. Our streaming smart order router is the most efficient way to trade cryptocurrencies across multiple exchanges. Our algorithms help traders execute their strategies smarter. You might be thinking, what comes next? You’ll just have to wait and see...

Huobi Prime offers digital currency investors a new way to Trade

Author: Nick Marinoff / Source: CCN

Tuesday, March 26 will see customers of the cryptocurrency exchange Huobi experience a whole new way of getting their fingers around cryptocurrencies. Known as Huobi Prime, the system is a coin-launch platform that ensures all currencies purchased by Huobi users are immediately deposited into their accounts and tradable against the Huobi Token (HT) with minimal delays, according to a company press release.

Customers will also have access to coins at below-market prices, as well as new projects and currencies not yet listed on major exchanges. Huobi’s executive team works with the project leaders of every coin or token listed, forming close partnerships and determining fair market values for users. Executives have also implemented tiered price limits to relieve customers of extreme volatility.

Speaking with CCN, Ross Zhang – head of marketing for Huobi Group – explains what inspired the new platform’s creation:

Low-quality coins and lack of access to ones with real potential are a perennial problem in the crypto space. While that is nothing new, I do think it’s taken on new importance in the ongoing bear market we find...

Industry sees crypto bottom as Bitcoin nears $4,100 and tokens gain 20%

Author: Joseph Young / Source: CCN

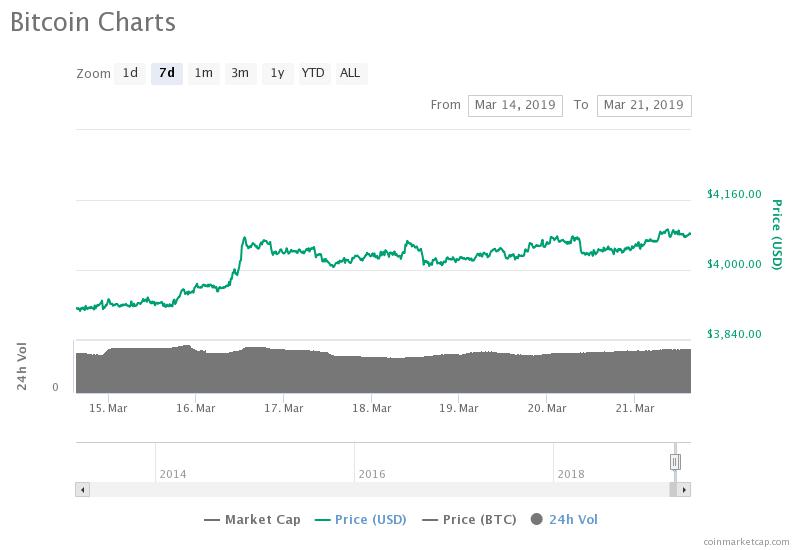

The valuation of the crypto market rose by $1.5 billion overnight as the bitcoin price closed on $4,100 and a handful of tokens recorded gains in the range of 10 percent to 25 percent.

Based on the global average price of bitcoin as shown on Coinmarketcap.com, the bitcoin price has remained above the $4,000 resistance level for more than seven days.

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click .

Throughout the past several months, many traders expressed their concerns over the inability of bitcoin to break out of crucial resistance levels and if the dominant cryptocurrency can continue to move past $4,000, the sentiment around the market is expected to improve.

Is the Bitcoin Bottom In? Too Early to Tell But Industry Execs Believe So

Earlier this week, reports suggested that some analysts still foresee the bitcoin price testing its previous low in the $3,122 to $3,500 range before initiating a proper accumulation phase in the upcoming months.

The cautious optimism towards the price trend of bitcoin comes from its performance since September 2018. Since mid last year, bitcoin has shown a pattern of experiencing several months of stability and becoming vulnerable to a large drop thereafter.

Bitcoin could avoid a large retrace to the $3,500 region if it can continue to climb up in the $4,000 and $5,000 range and a growing number of traders have begun to forecast a gradual climb to key resistance levels.

— C3P0 [Wookiemood] (@__BTC3P0__) March 20, 2019

Anthony Pompliano, the co-founder and general partner...

Insights from the "future of crypto trading" meetup with FRST in Chicago

What do you get when you add a bitter cold and windy city, over 50 cryptocurrency enthusiasts, and three informative presentations? The Chicago Ethereum Meetup of course!

As you may have read, we made a short presentation to the group about our smart order router and algorithms we’re developing. We talked to founders of a handful of digital asset traders and we’re humbled by the feedback we received about our technology.

If you weren’t lucky enough to be at the meetup, don’t despair, I’ve embedded a video of my presentation below. Take a look at let us know what you think!

FRST’s presentation was mind-opening, it’s unreal to see how much information is available at the wallet and transaction level and how it can be used to trade cryptocurrencies more intelligently. You can read more about FRST here

The final presentation was by Andrew Gordon, an accountant specializing in cryptocurrency tax law. Tax time for crypto traders can be a nightmare, but he shared some great information about how to streamline and simplify the process. You can learn more about him here.

If there was one main takeaway from the meetup it’s that there are so many areas of the digital assets ecosystem that are currently unexplored. It’s said that 99% of the ocean floor is currently unexplored and I believe we are currently in the same place with blockchain and digital assets.

Bitcoin Price Trapped in Key Make-or-Break Trading Range

Author: Omkar Godbole / Source: CoinDesk

View

- Bitcoin is trapped in a trading range defined by the 200-week simple moving average and the 200- week exponential moving average, currently at $3,404 and $4,106, respectively. Therefore, the outlook as per the weekly chart is neutral.

- A weekly close (Sunday, UTC) above $4,106 would confirm a longer-term bearish-to-bullish trend change and could fuel a rally toward $5,000.

- A weekly close (Sunday, UTC) below $3,404 could revive the sell-off from November highs above $6,500 and allow a drop to levels below $3,000.

- The odds of a drop to the lower edge of the trading range would improve if BTC invalidates a bullish candlestick pattern created on Feb. 27 with a move below $3,658.

Bitcoin is trapped in a key trading range defined by the 200-week simple moving average and the 200- week exponential moving average, currently at $3,404 and $4,106, respectively

The cryptocurrency needs a break above the upper edge needed to confirm a longer-term bull reversal. Conversely, a move below the lower bound of the range could revive the bear market.

Prices fell below the 200-week EMA in the third week of November, bolstering the bearish view put forward by the high-volume breach of the crucial support at $6,000 on Nov. 14.

The ensuing sell-off, however, ran out of...