Virginia Police Department Pension Fund is Betting on Bitcoin

Author: P. H. Madore / Source: CCN

Fairfax County, Virginia has targeted part of its pension fund toward investments in the Bitcoin and cryptocurrency industry, as well as blockchain technology in general. Now, they’re explaining why.

Fairfax County Retirement Systems Director Jeff Weiler published a post in response to CCN and other media’s reporting on the county’s decision to invest in Morgan Creek’s latest offering, the Blockchain Opportunities Fund. Oversubscribed from its intended $25 million, the fund invests in blockchain companies. It captured $40 million from two Fairfax County pension plans and other institutions.

Less Than 1% Of Two Retirement Funds Allocated to Crypto Ventures

First things first, the post gives specifics about the amounts invested. In total, the Virginia retirement system dumped $21 million into the fund. $10 million is from the county employee’s retirement fund while $11 million is from the police officer’s fund. They represent 0.3% and 0.8% of the funds’ total assets, respectively.

The post’s intention is to assuage any concerns that might have arisen in the minds of retirees. As CCN clearly stated, the play was not strictly a Bitcoin buy. Instead, Morgan Creek will use the fund to invest in blockchain companies like Coinbase and Bakkt,...

Crypto Market Update : Bears are Back, year-end rally nearby?

Author: Yoni Berger / Source: CryptoPotato

After a positive week for the alternative coins, a correction came to remind us of the risks involved with market volatility. However, the sharp declines have already been halted for the moment, getting closer to the dangerous $6000 zone.

Ahead of the expected Fork of Bitcoin Cash hard fork, the price of the currency has risen by tens of percent and has attracted considerable interest from traders and investors who are eyeing the market.

In light of the upcoming decisions regarding Bitcoin ETFs and other financial instruments related to the crypto markets, a trend has recently been initiated by regulators turning to large-volume crypto exchanges that affect the Bitcoin price and other altcoins in order to try to understand the price discovery mechanism.

The end of the year is near, and November began with a positive altcoin trend. The recent price hikes brought a positive sign to the market. But if we put the prices of the coins aside and look at the development of the infrastructure, the number of companies, employees and the partnerships that are being formed, one might expect another bullish wave in the near future.

Bitcoin continues to be the dominant and leading currency in the market and begins to show signs of stability with support around $6,200.

Bitcoin dominance 52.2% | Market Cap: $211 billion | Trading volume: $10 billion

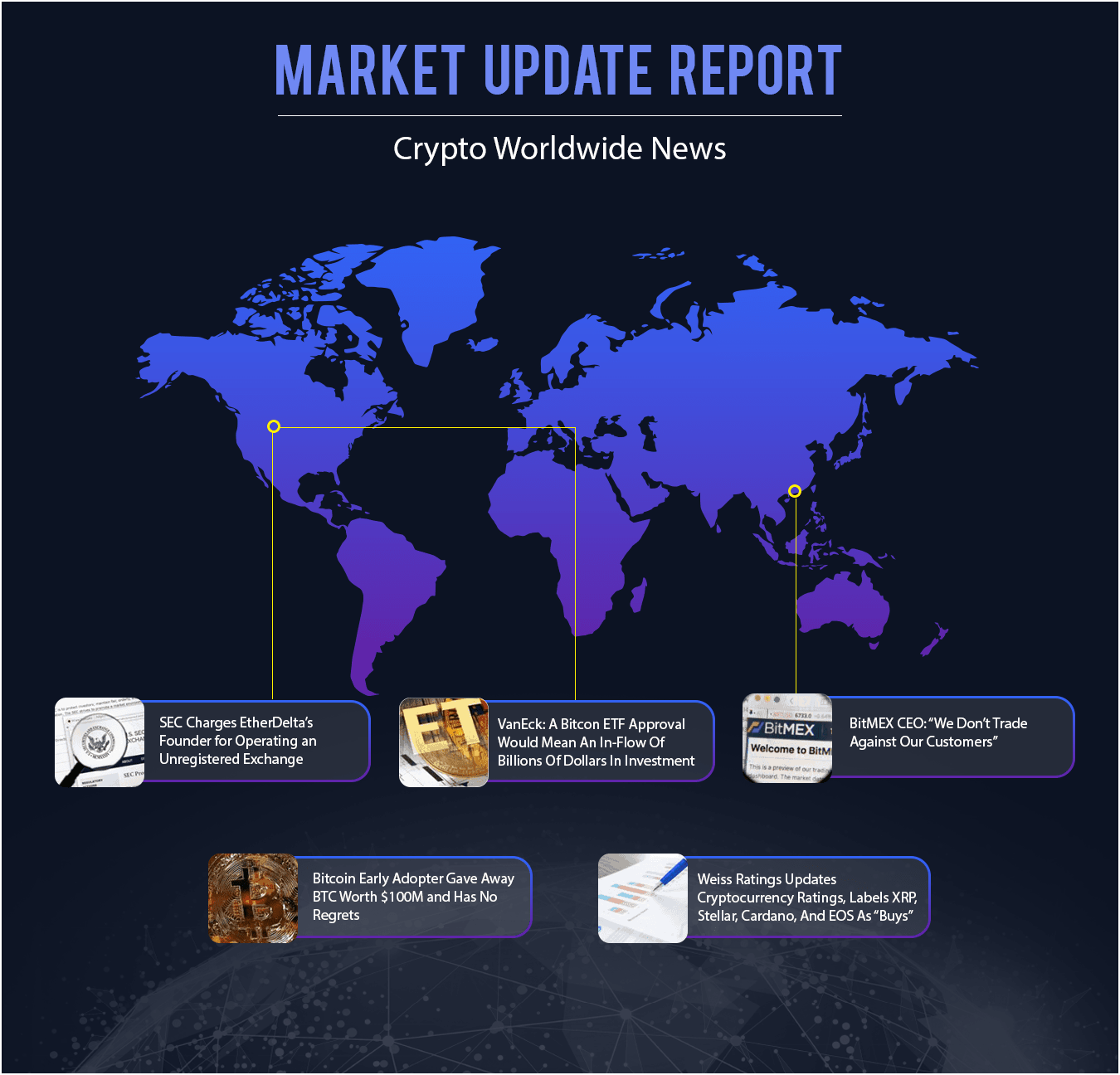

Crypto News & Headlines

SEC Charges EtherDelta’s Founder for Operating an Unregistered Exchange. The U.S SEC has heavily fined Zachary Coburn for operating an unregistered platform that allows people to buy and sell tokens that the agency had earlier...

Transitioning from bitcoin depression to disbelief to opportunity

Author: Kiril Nikolaev / Source: Hacked: Hacking Finance

Based on market cycle psychology, depression is the state where people have lost all hope in the market. They believe that the downtrend is a bottomless pit and the market will never again reach its former glory. This discourages everyday investors from entering the market when in fact, this is the point of maximum financial opportunity. Time and time again, markets bottom out when ordinary people have abandoned them.

This is exactly what we’re seeing in Bitcoin (BTC/USD). The hype that surrounded the cryptocurrency almost a year ago is completely gone. The interest over time, when looking at google trends, is at its lowest in 12 months. More importantly, many people believe that it can go significantly lower.

Current market sentiment maybe depressive but the charts show that the end is almost near. In this article, we show how Bitcoin may be transitioning from depression to disbelief.

A Comparison of Market Cycle Psychology Chart and Bitcoin Chart

Disbelief is the state where the market shows signs of life but participants ignore them. They do so because they think that the downtrend is not yet over and the rally is just another pump and dump scheme to slaughter newbies.

We believe Bitcoin is getting ready to make you a non-believer. To understand why we have this point of view, allow us to first show you the market cycle psychology chart.

Disbelief comes after a boring and depressed market. If you’ve been following Bitcoin’s price action since September, you’d know that the past few months have been the longest. Volatility has been almost non-existent. There were times when Bitcoin traded within a $10 range. At that point, we knew that Bitcoin was in a state of depression.

If you’re skeptical, the next chart should help alleviate your concerns.

Bitcoin daily chart over market cycle psychology chart

We overlayed the Bitcoin daily chart on top of the market cycle psychology chart and we have an almost perfect representation of market sentiment over the last twelve months.

Currently, the market is so depressed that...

Cryptocurrency Retail Investor Capital Is Not Dead

With major events unfolding in the cryptocurrency space surrounding institutional investors of late, little attention has been given to the retail investor.

Author: Gerelyn Terzo / Source: Hacked: Hacking Finance

Andreessen Horowitz stole the spotlight with its recent debut of a $300 million cryptocurrency fund, but meanwhile, it’s done little to prop up the bitcoin price, which continues to trade in the doldrums. Meanwhile, naysayers have been doubting that retail capital will ever find its way back into this space again.

If you ask Bart Smith, who spearheads digital assets at Susquehanna, a wave of retail capital will serve as the next catalyst to ignite a crypto rally. Smith told CNBC:

“Frankly where you have seen demand is from retail investors in the U.S. Coinbase, Gemini, Circle — all those people are servicing retail investors.”

First-Mover Urgency

Smith recalls the recent SEC decision that the No. 2 cryptocurrency Ethereum should not be classified as a security and therefore won’t be regulated by the Wall Street watchdog. But other coins, he pointed out, don’t have...